When markets are moving down, investors may feel like they need to wait on the side lines to see what will occur. The issue with that approach is that markets look ahead, so by the time challenges fade, the market has already reacted, and you have missed out.

Stock Market Performance

Stock market performance history

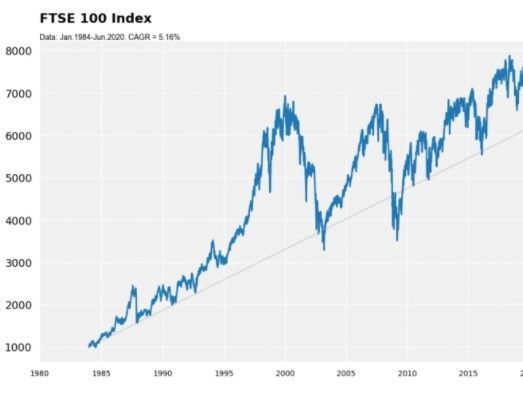

Stock markets around the world all show an upward trajectory over time. The graphs of the US Dow Jones and the UK FTSE100 attest to the roller coaster ride investors have been on over the past 40 years. After each major slump, there has been recovery and the latest downturn because of the pandemic is no exception.

Since the start of the pandemic, yields have risen sharply over a short period of time on about three occasions, each of which have been accompanied by a sell-off in the Nasdaq and growth sectors broadly. Historically, these selloffs are relatively short-lived, which is why there is no reason to abandon good quality technology companies. Speculative behaviour has started to leave the market as many of the more obscure technology names with limited or no earnings in more niche areas like space exploration have seen their share prices plummet.

What might happen next?

In 2022, there is no doubt that interest rates will rise but the extent to which they will rise is unclear. Although the US Fed has indicated that the plan is for several interest rate rises over the next 12 months, some of these increases could yet be avoided if inflation begins to moderate. The trajectory of the pandemic will doubtless also be a big factor in how aggressive the Fed needs to be with their interest rate policy.

Impact for investors

As a result of this continuing uncertainty, our Nexus Portfolio manager Quilter Cheviot continues to favour a balanced approach to equity-market exposure in 2022, focusing on developed market (DM) stocks rather than emerging market (EM). DM stocks are weighted towards areas that we favour long-term such as technology and companies exposed to the transition to net zero. However, tighter interest rate policy and any further challenges could prove more favourable to EM stocks. Timing the market is impossible and is best avoided so a globally diversified and multi asset portfolio such as our Nexus Portfolios, continues to be a sensible option as the markets continue to settle.

Advice from Blacktower Financial Management

Keeping up with all the changes affecting the stock market and the potential impact on your wealth is challenging and time-consuming. Blacktower Financial Management wealth advisors can assess your situation, helping you to identify the best way to structure your wealth for maximum returns. We will regularly review your position to ensure that you achieve your financial goals now and in the future. Contact one of the representatives at our Lisbon office today for your free no-obligation discussion.

Blacktower in Portugal

Blacktower’s offices in Portugal can help you manage your wealth to your best advantage. For more information contact your local office.

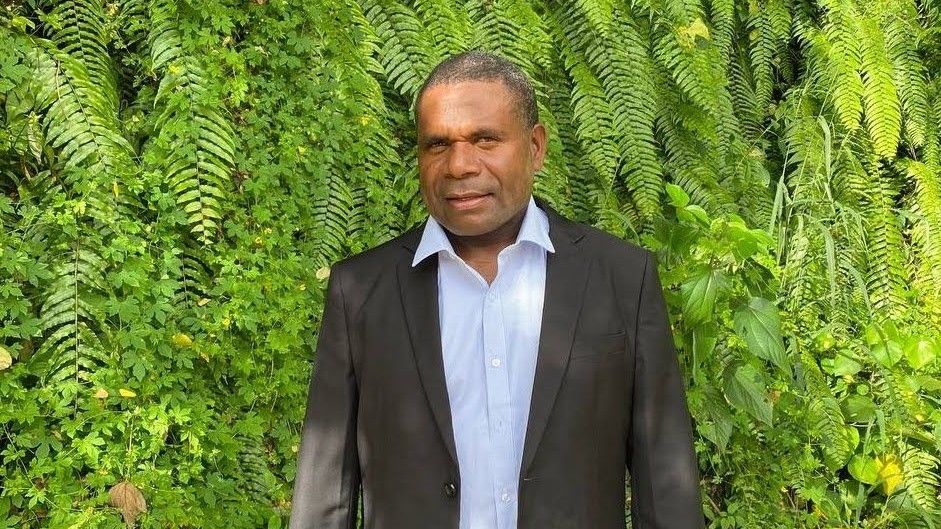

Antonio Rosa is the Associate Director of Blacktower in Lisbon, Portugal.

Blacktower Financial Management has been providing expert, localised, wealth management advice in Portugal for the last 20 years. We can help with specialist, independent advice on securing your financial future. Get in touch with us on (+351) 214 648 220 or email us at info@blacktowerfm.com.

All very well for them to say,however they are bleeding your dry with their annual fees which are charged whether you make or lose money.

Think about it!

By James from Algarve on 21 Feb 2022, 06:46