Portugal is experiencing a remarkable trend as its foreign resident population continues to soar, reaching a record high of 781,915 citizens in 2022. The increasing number of foreign residents is having profound implications on the country’s finance, economy, and overall societal well-being. As the seventh consecutive year of growth unfolds, Portugal is on the cusp of having foreigners make up nearly 10% of its population, signalling a turning point that demands careful consideration of the financial elements at play.

Economic growth and labour market

One of the most significant impacts of the rising foreign resident population is on Portugal’s economy and labour market. Skilled immigrants are filling crucial gaps in the labour market, injecting diverse skills and expertise into various industries. This infusion of talent enhances productivity and competitiveness, fueling economic growth and development. Businesses are benefiting from a growing labour force, leading to potential foreign investment that further boosts economic prosperity.

Tax revenues and consumer spending

The financial implications of the growing foreign population extend to tax revenues and consumer spending. Foreign residents who earn income in Portugal contribute to the country’s tax coffers through income taxes, social security contributions, and other indirect taxes. This influx of tax revenue can potentially bolster the government’s ability to invest in public services and infrastructure, raising the overall standard of living for both residents and immigrants alike.

Moreover, the increasing number of foreign residents leads to a surge in consumer spending, stimulating various sectors of the economy. The rise in demand for goods and services can lead to business expansion and job creation in sectors like retail, hospitality, and tourism, further contributing to economic growth.

Real estate market and social services

The real estate market is also affected by the growing foreign resident population. As more people seek housing, there is increased demand for both rental properties and property purchases, potentially driving up property prices in certain regions.

While this can benefit property owners and developers, it may make housing less affordable for some locals.

Furthermore, the influx of immigrants places additional strain on social services such as education, healthcare, and social welfare.

Ensuring successful integration and social cohesion requires adequate funding and support, leading to careful financial planning and budget management.

Remittances and entrepreneurship

The financial landscape is influenced by remittances sent by foreign residents to their home countries. While remittances support families abroad and contribute to economic development in their home nations, they can also result in an outflow of money from the local economy, potentially reducing its impact on Portugal’s domestic economic growth.

However, immigrants can also be catalysts for entrepreneurship, creating new businesses that generate employment and foster innovation. This entrepreneurial spirit further diversifies the economy, offering long-term economic benefits.

Portugal’s growing foreign resident population has far-reaching financial implications that impact various aspects of the economy and society. As the country nears the 10% mark in terms of foreign residents relative to the total population, prudent financial management, inclusive policies, and support for social integration will be essential to maximise the positive effects and navigate the challenges that come with this demographic shift. By embracing diversity and leveraging the potential benefits of immigration, Portugal stands to enhance its economic prospects and foster a thriving, inclusive society for both locals and newcomers.

For more information please contact Blacktower Financial Management.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

Interesting article with lots of statements made that look reasonable but without some hard stats behind them it is difficult to validate them. The one in particular that stands out is the claim that there is an outflow of money to other countries by foreigners. How significant is this? I think it would be small compared to the spend by more affluent migrants with more disposable income. Migrants who send cash home tend to be in the lower socio-economic categories and are likely to be eclipsed by those from the higher income groups.

By Russell Taylor from Other on 28 Jul 2023, 15:11

Well my only concern is that this foreigner will respect the costumes and culture and above will making any effort to learn the language ? Many still aspect constantly that the Portuguese talk in English or other languages and this isn't right or correct . The only way of his people integrate is learning the language instead living in segregated colony where no one is interested to learn anything .or even to adapt to culture and costumes .

By Isabel Oliveira from Lisbon on 29 Jul 2023, 08:17

Hey Isabel I understand your point. Here in the states we used to be a "melting pot" where different cultures and customs melted together to form a great country. It was sort of like a stew. Today we are more like a buffet table. The only thing we have in common is that we are all on the same table, but every dish is different and separate. No one cares to learn the language or customs.

By Tony B from USA on 29 Jul 2023, 18:40

THAT'S THE PROGRESS WE ALL WANT FOR OUR GREAT COUNTRY, PORTUGAL. UNFORTUNATELY, SEF IS ON THE OTHER HAND FRUSTRATING MORE THAN HALF OF THAT POPULATION BY DENYING THEM RESIDENT PERMIT, TAKING THEM OUT OF LABOUR FORCE HENCE MAKING THEM A MENACE TO THE SOCIETY.

By PRINCE TOCHUKWU AWODIKE from Lisbon on 30 Jul 2023, 07:14

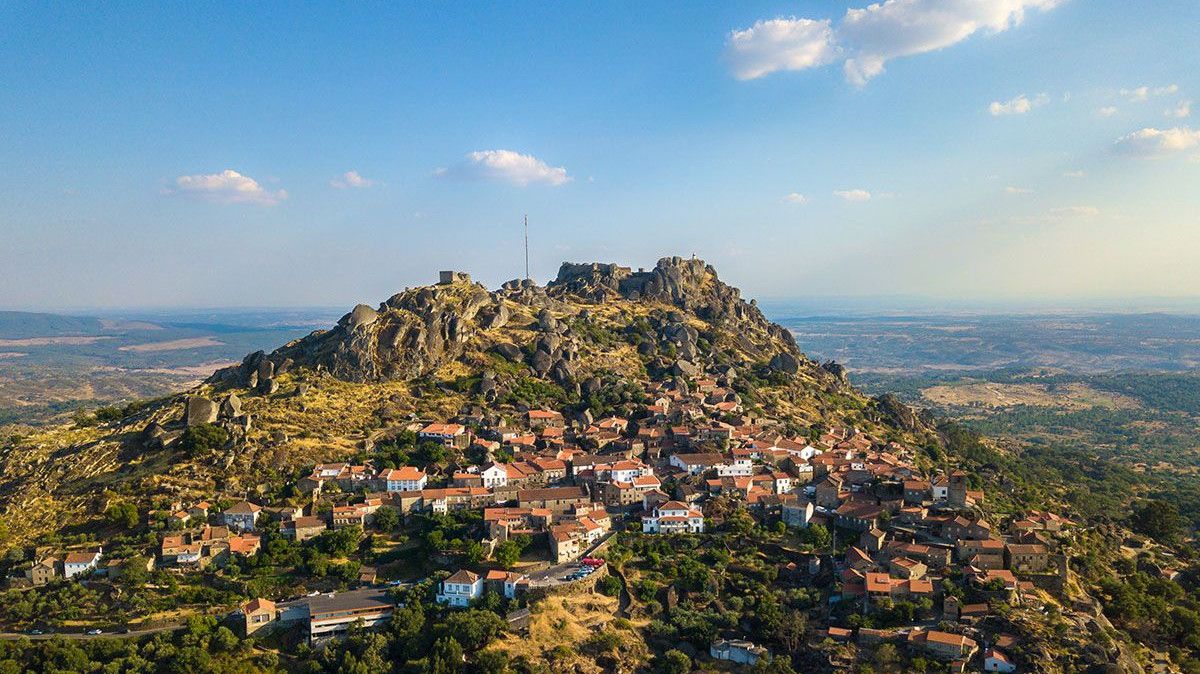

I bought my house in Torre, Lourical do Campo in 2017 - since then I have endeavoured to use local services & tradesmen for any renovations I need. We go to the local cafes and try to use our limited Portuguese.

Here in the UK we are now over-run with so many cultures that have bought up whole streets and areas and keep to themselves and do not intrigrate themselves, and often blatantly flout our laws.

I love the culture and history of portugal and will always respect both!

By michael saint from UK on 30 Jul 2023, 07:48

Wait for the crash!!!!!!!

By F from Porto on 09 Aug 2023, 15:43